German Spectrum Auctions Results

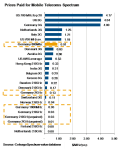

August 4, 2010The mobile telecoms spectrum auction in Germany ended on the 20th of May 2010. On offer were a total of 358.8 MHz of paired and unpaired spectrum in the 800 MHz, 1.8 GHz, 2 GHz, 2.6 GHz bands. The auction was a combinatorial simultaneous multi-round auction. That is to say all blocks were auctioned simultaneously and bidders could place a single bid for packages of spectrum blocks rather than bidding individually on separate blocks. The overall result was an average price of US$ 0.19 (€0.15) per MHz per head of German population ($/MHz/pop is the most common measure of price for spectrum). However, there were significant variations in price across the different bands but overall the prices are reasonable.

The key determinant driving these reasonable spectrum prices were firstly the frequency bands that were available and second the number of bidders. For example, the high prices paid in the Indian 3G auction, which closed only 1 day earlier on the 19th of May, where bidders paid up to US$4/MHz/pop, are mainly a reflection of the fact that there were many more bidders than available spectrum and only 3 out of 7 or 8 bidders ended up with spectrum. The number of bidders vs. available spectrum also resulted in the high prices paid in the auctions in the USA in 2007 and in Canada in 2008. It’s down to economics class 101, supply and demand.

All eyes were on the “digital dividend” 800 MHz band. The propagation characteristics of this sub 1 GHz band produce wider geographic coverage outside urban areas and better in-building penetration is dense urban areas. Prices paid for the 800 MHz spectrum were relatively low, amounting to an average of US$ 0.91 / €0.73 per MHz per head of German population. By comparison prices in the US 700 MHz auction in the top 20 areas, namely cities, reached $4.17/MHz/pop. The US average at the time was US$ 1.18, which is only 30% higher than prices paid in Germany. However, the US has a much lower population density than Germany, and generally the higher the population density the higher the prices paid.

The reasonable prices paid for the 800MHz spectrum in the German auction are due to three factors:

• Only the four incumbent operators (Vodafone, Deutsche Telekom, Telefonica O2, E-Plus) bid for the spectrum, there were no new entrants.

• The unusual aspect of the German auction was that the 800MHz spectrum band had been designated to provide mobile broadband coverage in rural areas. Operators must first build coverage for 90% of the population in villages with a population of not more than 5,000 inhabitants, in phase 2 towns from 5,000 to 20,000, in phase 3 towns 20,000 to 50,000 and only in phase 4 can the spectrum be deployed in larger cities. Mobile operators usually roll-out networks first where there is the greatest density of population in order to maximise the return on their investment – i.e. in urban areas. The value of the spectrum to an operator will be lower if they have to invest in what they would normally regard as marginal or even uneconomic areas first.

• Vodafone and Deutsche Telekom were restricted to a maximum of 20 MHz each out of 60 MHz on offer. This meant the fight over the remaining 20 MHz was between Telefonica O2 and E-Plus. In the event Telefonica O2 placed a higher value on the spectrum and outbid E-Plus, obtaining 20 MHz and E-Plus had to content itself with spectrum in the 1.8, 2.0, and 2.6 GHz bands.

Prices paid for the higher bands were only a fraction of the 800 MHz band. Since E-Plus did not buy any 800 spectrum, the operator ended up paying only US$ 0.06/MHz/pop (€0.05/MHz/pop) compared to the three others paying an average of US$ 0.22/MHz/pop (€0.17/MHz/pop). Yet E-Plus gained two 10 MHz blocks in the 2.0 GHz band which was the next most valuable band.

Prices paid for the 2.6 GHz band with an average of US$0.03/MHz/pop (€0.02/MHz/pop) were low, but in line or even slightly above other recent 2.6 GHz auction in Europe, some of which only achieved the reserve price of less than $0.01/GHz/pop. The 2.6 GHz band is the primary band for the deployment of LTE (4G) and is ideal to provide capacity for mobile broadband in densely populated areas. The coverage roll-out conditions do not apply to the 2.6 GHz band and Germany has many cities with high concentrations of populations which makes this spectrum potentially more valuable in Germany than in many other countries.

Leave a comment